What is a Trust?

A trust is a legal relationship and not a separate legal entity. The relationship is created by the person wishing to create the trust (settlor or grantor) and the trustees (the persons willing to undertake the office of trustee). As part of this relationship property (trust fund) is declared to be held by the trustees for the benefit of certain parties (beneficiaries) or for certain purposes.

A trust has the following characteristics:

- The assets constitute a separate fund and are not a part of the trustee’s own estate.

- Title to the trust fund stands in the name of the trustee or in the name of another person on behalf of the trustee.

- The trustee has the power and the duty, in respect of which it is accountable, to manage, employ or dispose of the assets in accordance with the terms of the trust and the special duties imposed upon it by law.

What is a Purpose Trust?

A purpose trust is a trust created to fulfil purposes rather than to hold property for beneficiaries. The concept was introduced in the Trusts (Special Provisions) Act 1989 and was conceived, primarily to respond to the need for a trust to be able to fulfil a useful role in a commercial setting – that of, the role of insulator. However, it can also be used for philanthropic purposes and estate planning purposes.

The introduction of the Trusts (Special Provisions) Amendment Act 1998 refined the law relating to trusts created for non-charitable purposes by requiring the following conditions to be satisfied.

- The purpose or purposes of the trust must be sufficiently certain to allow the trust to be carried out.

- The trust must be lawful and it must not be contrary to public policy.

Under Bermuda law, a purpose trust may last indefinitely or for a specified term of years.

In Bermuda hybrid trusts, with both purposes and beneficiaries, are permitted.

The trust deed may provide for the appointment of an enforcer, which is a role that is similar to that of the protector. However, the appointment of an enforcer to enforce the trust and provide for the appointment of successors is not a requirement in purpose trusts governed by Bermuda law. The Trusts (Special Provisions) Act provides the settlor, a trustee, or any person with a sufficient interest in the trust, the power to make application to the court to enforce the purpose trust. In default of any other arrangements, the final power of enforcement rests with the Attorney General.

Why use a Purpose Trust?

Purpose trusts have the following advantages:

- Flexible vehicle – there is a lack of rigid requirements for the creation and operation of trusts when compared to companies.

- Trustee duties – A trustee of a purpose trust need not be concerned with duties owed to beneficiaries with competing claims and interests.

- Confidentiality – The terms of the trust, its settlor and the purposes are confidential.

- Registration – Trusts are not required to be registered except for certain trusts which are themselves established to fulfil a specific statutory obligation, for example trusts established to provide pension benefits to persons with Bermudian status and their spouses under the National Pension Scheme (Occupational Pensions) Act 1998.

- Set up – In Bermuda, trusts are relatively easy to set-up, requiring fewer formalities than the incorporation of a company.

- Protection – Assets are dedicated to a specific purpose and are “ring-fenced” from insolvency risks, thereby creating a protected fund so that “bankruptcy remoteness” can be achieved.

- Balance sheet – The transaction may be effected “off balance sheet” or as an “orphan” structure in relation to its originator.

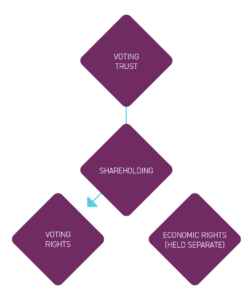

- Voting – Purpose trusts can facilitate arrangements to separate voting from economic control.

- Ownership – Purpose trusts can provide an ownership vehicle for private trust companies (PTCs), special purpose vehicles (SPVs) and special purpose insurers (SPIs).

- Security – Purpose trusts can be used to hold a fund as security for parties’ obligations in commercial transactions.

Purpose trusts have also been used for philanthropic purposes including for research and development. In Bermuda, even prior to the introduction of purpose trust legislation, a trust established for charitable purposes was valid even if it did not have beneficiaries. However, many clients wish to establish trusts for philanthropic purposes which may not fall within the definition of “charitable”. Bermuda’s purpose trust legislation provides that trusts formed for philanthropic or other purposes are valid provided, as required for all purpose trusts, the purposes are sufficiently certain to be carried out, lawful and not contrary to public policy.

Examples of uses of Purpose Trusts

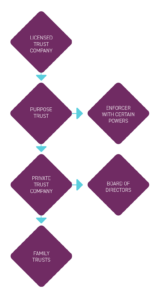

Private Trust Company (PTC) Structure

Purpose trusts have had considerable appeal when used in conjunction with PTCs. Through the use of a purpose trust, the settlor or grantor is separated from the ownership of the company which acts as the trustee of a family trust. In addition, in contrast to an individual trustee, a corporate trustee does not require a new trustee to be appointed upon the death or resignation of one of its directors.

In this example a licensed trust company creates the purpose trust by way of declaration. The purpose of the trust is to hold shares in the private trust company. A PTC can be formed with nominal share capital. It is not generally contemplated that PTCs will charge for their services or otherwise accumulate income or assets. For example, family members can sit on the board of this PTC. The settlor or grantor may also wish for senior individuals employed by the licensed service provider or a corporate director provided by a licensed trust company to be a director of the PTC. This may provide more diversity and local knowledge of Bermuda‘s trust and regulatory environment to the PTC board. The PTC may also be used to insulate a licensed trustee from the risk associated with directly holding shares of a trading company or other high risk investments.

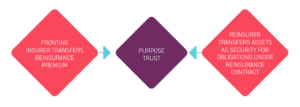

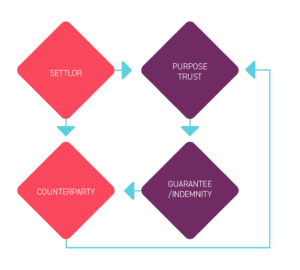

Security (or collateral) trusts

Purpose trusts are frequently established to hold security or collateral. The trust deed will set out the circumstances in which such security can be released. We have seen this structure used as a means for reinsurers to provide security to fronting carriers for their obligations under reinsurance agreements. These types of security trusts, sometimes referred to as collateral trusts, are often seen to provide more accessible, cost-effective, bankruptcy remote and independently managed security arrangements in comparison to letters of credit, funds withheld arrangements and pledge arrangements. With an insurance market rivalling London and New York, and being the jurisdiction of domicile of more captive insurers in the world than any other, Bermuda has expertise with these types of trusts.

The purpose trust may be established as a collateral fund arrangement under which the trustee of a purpose trust will issue a guarantee or undertake an indemnity obligation in favour of a counterparty to the person who establishes the purpose trust (settlor). The settlor may fund the purpose trust fully in respect of its exposure under the guarantee or indemnity to be issued by the trust. Alternatively the settlor may only fund the trust in respect of part of its exposure on the basis that the trust fund will be invested in high grade zero coupon bonds or fixed interest securities with profits and gains rolling up inside the trust fund with the intention that over time these retained profits and gains together with the trust capital will match the exposure under the guarantee/indemnity or other obligation. In these circumstances care will need to be taken to expressly limit the trustee’s personal liability. Alternatively, the trust may only be funded with sufficient monies to purchase insurance cover in respect of its exposure if any claim is made under the guarantee indemnity or other obligation. The trust will operate as a limited recourse vehicle so that the guarantee or indemnity obligation can only be met and satisfied out of and to the extent of monies or assets in the trust fund. Until a claim is made under the guarantee or indemnity or the primary obligation which is secured by the purpose trust is otherwise discharged, the trust cannot be revoked and will be insolvency remote. At the end of the trust period any monies or assets remaining in the trust can be repaid to the settlor.

Sinking Fund Trusts/Company Reserve or Provision

The purpose trust concept offers the benefit of being able to dedicate monies or other assets comprising the trust fund for pre-defined business or commercial purposes without any person being entitled to claim a direct ownership interest in the trust or prevent application of the monies or assets toward the specified purpose.

The purpose trust may be used to establish a sinking fund to enable monies to be set aside and paid regularly by the company to the trustees so that an adequate fund will be available over time to meet the costs of a particular project, for example major repairs to a building, installation or de-commissioning of expenses or, environmental cleansing costs.

Purpose trusts can also provide a flexible solution where a company or its directors wish to set aside monies or assets to create a reserve fund or a provision in respect of an anticipated funding obligation of the company. In the absence of vitiating factors at the date of establishment of the purpose trust, the reserve fund or provision would be ring-fenced from insolvency risk of the company or creditor claims against the company which do not relate to the trust purpose. For example, such a scheme might be used to create a ring-fenced reserve to fund top-up contributions to directors’ pension arrangements.

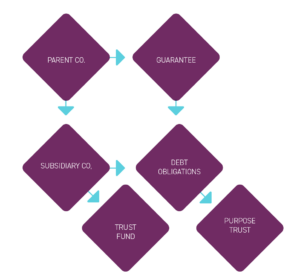

Divestment of Debt Obligations

A subsidiary finance company may have issued debt instruments supported by a guarantee from its parent company in favour of the holders of those debt instruments. The terms of the debt instruments may prevent early repayment and accordingly the finance subsidiary may wish to divest itself of the direct obligation to meet repayment of the debt instruments in order to improve the group’s credit rating and simplify accounts presentation perhaps in preparation for entry into another financing transaction or parent group acquisition. In this scenario, the subsidiary finance company may form a purpose trust with an independent trustee and arrange sufficient funding to enable the purpose trust to cover interest and ultimately capital repayment obligations on the debt instruments. With the agreement of the paying agent/trustee of the debt instruments, the obligations of the subsidiary finance company may be transferred to the trustee of the purpose trust. The contingent liability of the parent company under the supporting guarantee may also be capable of being released at this point so as to remove it from the consolidated balance sheet liabilities of the group.

Private Investment Fund

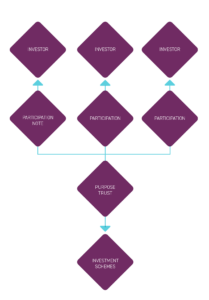

A purpose trust structure may be used as an alternative to a traditional unit trust structure where investors or capital providers are beneficiaries of the trust and have a proprietary interest in the underlying investments. The trustee of the purpose trust may issue participation notes to investors or capital providers who, in contrast to the unit trust arrangement, would not participate as beneficiaries under the trust but will have the contractual rights set out in the terms of the participation notes. These contractual rights may consist of the right to participate in the profits from the underlying investments. Investors and other capital providers can rank equally for participation in the arrangement or participation notes can be investor specific with different rights or entitlements conferred between investors/capital providers. For example, income and revenue profits can be split from capital profits and allocated to different investors. The use of a purpose trust also avoids complications which may arise if a corporate fund vehicle were used as a result of company law requirements defining distributable profits and setting out maintenance of capital requirements and restrictions on return of capital prior to a winding up.

Directors’ Run-Off Insurance Trusts

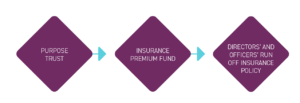

Boards of directors often fail to put in place arrangements to fund a reserve for insurance premiums which need to be paid following the acquisition of their company in a take-over or sale, or where it ceases operation, in order to provide run off insurance cover for themselves in respect of risks arising from acts and omissions carried out by individual directors or the board prior to the take-over or sale or liquidation of the company. Company law generally permits the company to pay the premiums on directors’ and officers’ insurance policies. Failure to fund a reserve by the company for premiums which will need to be paid at or following take-over, sale or liquidation often means that if the directors want the protection of run-off cover they will have to purchase the same from their own resources.

However, by establishing a purpose trust the board can arrange for a contingency or reserve fund to be built up by transfers of monies from the company to the purpose trust to be used for the purchase of run-off insurance policies. The funding may be by means of one lump sum payment by the company or may be spread over a period of time by means of a series of smaller payments into the trust. If the company subsequently becomes insolvent the trust fund should be available to ensure that adequate insurance cover is purchased post the winding up date to cover the ongoing risk of claims to which directors may be exposed during limitation periods which may run for several years after the winding up date. Care will need to be taken to structure the trust so that it is insolvency remote and cannot be challenged by creditors of the company.

Alternatively, if a company is sold as a going concern and becomes part of a new corporate group it is normal for the group insurance arrangements of the acquiring group to cover the directors of the new subsidiary for directors’ and officers’ risk, but only in respect of risks arising after the date of acquisition of the new subsidiary. The directors of the subsidiary may not be covered under the new parent group’s insurance for risks which predate the acquisition. By using a purpose trust to build up a reserve fund in advance of the take-over or sale, the board of the target company can arrange purchase of appropriate run-off cover without having to pay for the same from their own resources.

Voting Trusts

Voting trusts are a well-known and long established example of the commercial use of trusts. For example, a trust may be established to own a minority stake in a joint venture company in which, for example, two principal parties have equal shares. The minority stake owned by the trust can be treated as “voting only” shares carrying no right to dividend or other economic interests. The voting rights attaching to the minority stake held by the trust will be exercised only in accordance with the views of an independent third party acceptable at the outset to both parties to the joint venture. Using an arrangement of this type may prevent deadlock between the parties at a later date.

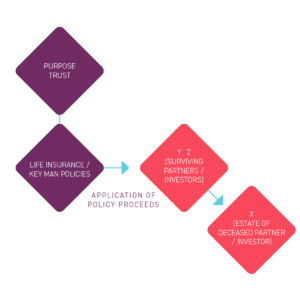

Partnership/Joint Venture Buy Out Trusts

This type of purpose trust may be established to deal with the death of a partner or joint venture investor. There may be a partnership or joint venture buy-sell agreement funded by insurance held by a trustee for the parties. The insurance money will provide the funds to enable the surviving partners to buy the interest of the deceased partner, thereby avoiding sale of the partnership or joint venture assets which might jeopardise the continuity of the enterprise.

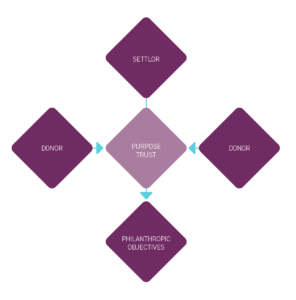

Philanthropy

Where a settlor wishes to establish a vehicle to promote certain interests or objectives which may be business related or philanthropic in nature but which fall wholly or in part outside the definition of charitable activities, it may not be possible to establish the vehicle as a charity in the settlor’s jurisdiction. An alternative approach would be to set up a non-charitable purpose trust under Bermuda law under which there is freedom to define the specific objectives which are to be promoted subject only to the overriding requirement that the purpose trust cannot be established for purposes which are unlawful, immoral or contrary to public policy.

Research and Development Trusts

Trust structures funded by commercial enterprises are being used like endowments in certain circumstances to carry out research and to develop new ideas and intellectual property. Examples include: pharmaceutical companies researching new products and disease treatment; commercial aviation companies researching and developing aeronautics; space shuttle manufacturers and the development of rocket propulsion; mining exploration; electronics; technology.

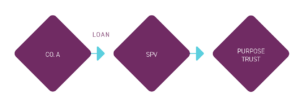

An example of how one of these trust structures might operate is:

- Large Company A wants to research and develop new ideas. Until it has a new product it cannot capitalise the cost of doing the research or include it on its balance sheet as an asset because research does not meet the asset recognition criteria for accounting purposes.

- Company A therefore lends funds to a special purpose vehicle (SPV) owned by a purpose trust (taking it off the balance sheet of Company A).

- The purposes of the SPV are to research, develop and identify new products.

Bermuda as a Trust Jurisdiction

Regulation and Infrastructure

Bermuda has a favourable and well-respected legal and regulatory regime and a robust professional services industry. Appeals from Bermuda’s Supreme Court are heard by the Privy Council in the United Kingdom. Some of the most well-known legal, accounting and trust administration service providers can be found in Bermuda. Each are highly capable with the set-up, management and administration of trusts. All of which combine to make a jurisdiction that is highly professional and able to meet the requirements of the most sophisticated clients.

The Trusts (Regulation of Trust Business) Act 2001 introduced an extensive system of trust licensing regulated by the Bermuda Monetary Authority and, in particular, requires that all public trust companies possess an unlimited trust licence. The Bermuda Monetary Authority screens and continually monitors licensed trustees to ensure that they are controlled by fit and proper persons, meet minimum net asset requirements, have adequate insurance, records, systems and controls and also that they carry out their business with integrity and skill.

Private Trust Companies (PTCs)

The Trusts (Regulation of Business) Act 2001 and Trusts (Regulation of Trust Business) Exemption Order 2002 formalised Bermuda’s PTC regime. PTCs are not permitted to carry on trust business (i.e. offer their services to the public). The PTCs memorandum of association must identify the trusts for which it intends to act as trustee. Bermuda’s PTC regime has become one of the most flexible and cost effective PTC regimes in the offshore world. There is no requirement that the directors or secretary of the PTC be resident in Bermuda. Further, there is no requirement for a licensed trust administrator to administer the PTC or the trusts over which the PTC is trustee, although it is often preferred for administrative purposes. However, a registered office and registered agent is required.

Trusts of unlimited duration

The Perpetuities and Accumulations Act 2009 which came into operation on 1 August 2009 abolished the rule against perpetuities for all trusts formed on or after 1 August 2009 other than trusts of Bermuda land. This Act now permits the formation of dynastic or perpetual trusts and has modernised the laws of Bermuda relating to the application of the rule against perpetuities to trusts.

Reservation of powers

The Trusts (Special Provisions) Act 2014 enhanced Bermuda’s reserved powers legislation to clarify the wide range of powers a settlor or grantor may reserve without affecting the integrity of the trust. This legislation has numerous advantages to individual and corporate settlors and grantors who wish to retain certain powers over trust assets.

Setting aside flawed exercise of powers

On occasions a fiduciary may, as a result of an error or incorrect advice, exercise a power in a manner which results in unintended tax or other adverse consequences. The United Kingdom decision of Re Hastings Bass 1975 enabled the Court to set aside a trustee’s exercise of power with the result that such unintended consequences may be avoided. However, during 2013, the United Kingdom Supreme Court cases of Futter v Futter and Pitt v Holt held that a breach of a fiduciary duty needed to be proved in order to set aside the exercise of power. These decisions would have the result that hostile litigation against the fiduciary would be required to set aside the exercise of the power. Alternatively, similarly hostile proceedings would need to be considered by the fiduciary against third party advisers who may have provided incorrect advice which the trustee relied upon to exercise the power.

The Trustee Amendment Act 2014 amended the Trustee Act 1975 to clarify the circumstances in which an exercise of a fiduciary’s powers can be set aside, with the result that the decision in Re Hastings Bass 1975, as it was applied prior to the United Kingdom Supreme Court’s decisions in Futter v Futter and Pitt v Holt during 2013, largely reflects the law in this area in Bermuda. The availability of this remedy means that applicants are more readily able to have flawed decisions set aside in an efficient manner without the costs, risks and delays associated with hostile litigation.

Taxation in Bermuda

In Bermuda there are no taxes on profits, income or dividends, nor is there any capital gains tax on trusts. There is nominal stamp duty on certain trust documents where the trust fund holds non-Bermuda property. There are a number of exemptions available from stamp duty for trusts of non-Bermuda property executed by a local trustee, pension trusts and, under the Stamp Duties (International Business Relief Act) 1990, trusts to which an international business is properly a party. An exempted party would be properly party when, for example, it acts as trustee or settles property into a trust. The position is different where the settlor is a Bermudian national or where the assets are Bermuda dollar assets.

Conclusion

Bermuda enjoys a first-class reputation as an offshore centre for trusts and trust business, and is highly regarded for its experience with all types of purpose trusts.

This guide was last updated in August 2021. This Guide is for general guidance only and does not constitute definitive advice. Please contact one of our lawyers if you require more detailed information.