Squeeze on liquidity

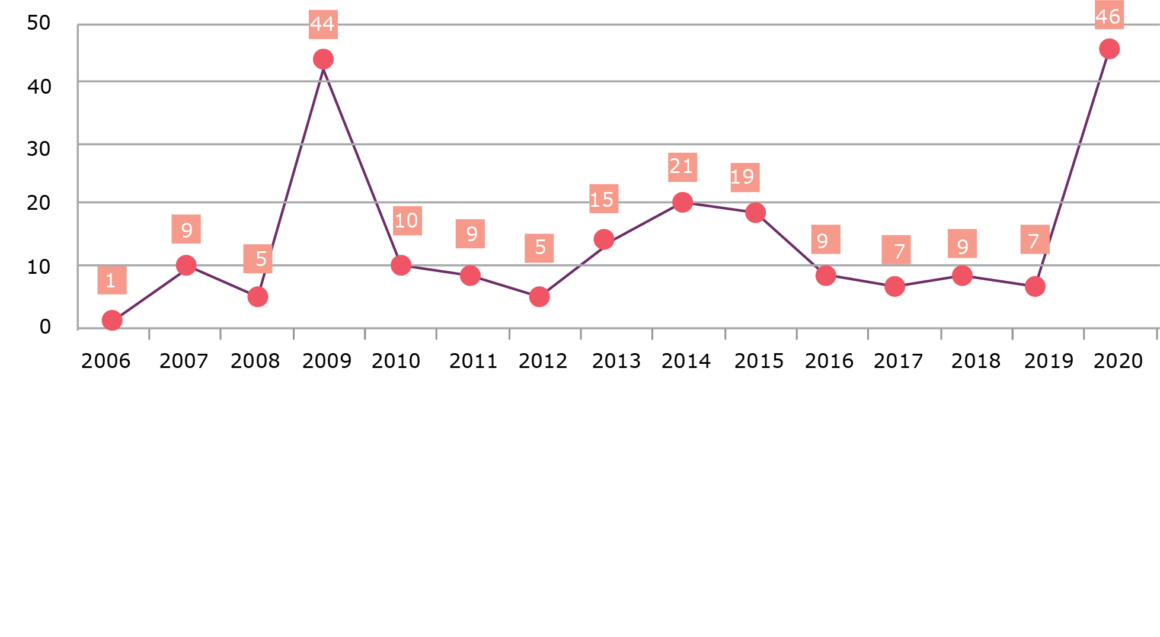

Since the onset of the crisis in early March 2020 we have seen our clients respond to anticipated liquidity difficulties in a number of ways. Well-capitalised clients have been able to tap into readily available cash following strong periods of trading prior to the crisis. Others have drawn on committed facilities taking advantage of low interest rates that continue to prevail whilst some clients have brought forward strategic asset disposals to provide liquidity buffers. In addition to the above, as was anticipated in April, we have seen a significant upturn in enquiries and instructions in connection with fundraising by using a Jersey cash box structure. According to data maintained by Thomson Reuters, there have been 46 cash box structures launched in 2020 so far (up until the end of October) which, as illustrated in the graph below, is already in excess of the 44 cash box structures launched in 2009 at the peak of the global financial crisis.

Cash Box Secondary Issues

Source: Thomson Reuters

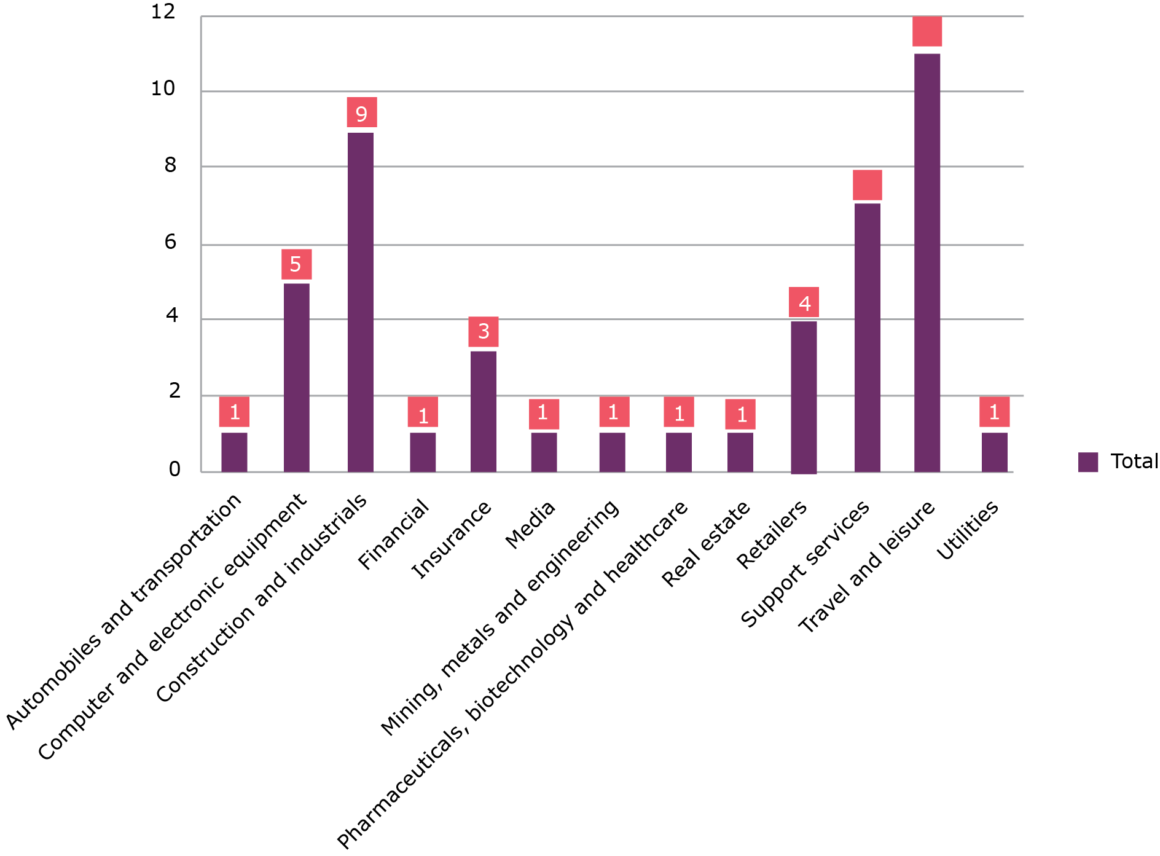

Cash box structures have been employed across a variety of sectors showing their versatility as a source of urgent liquidity as well as illustrating the impact of the coronavirus crisis across the global economy.

Cash Box Issues by Sector

Source: Thomson Reuters

The average value of each cash box has been GBP198,034,783 and 42 of the 46 identified structures involved the use of a new company incorporated in Jersey demonstrating the dominant position the jurisdiction enjoys for implementing fundraising in this manner.

What next?

On 4th September 2020 the Pre-Emption Group (PEG) extended its recommendation that investors, on a case-by-case basis, continue to consider supporting placings by companies of up to 20% of their issued share capital over a 12-month period. It remains to be seen whether PEG will extend this recommendation beyond 30th November 2020, with one view being that by then, almost 8 months into the pandemic, companies should have taken the necessary steps to manage their liquidity requirements without the need for emergency fundraising. The recent imposition of a second lock-down may be a relevant factor in the PEG extending this recommendation further into early 2021.

Due to the continued uncertainty in markets caused by the crisis, we expect cash box structures to remain, for the rest of 2020 and into Q1 of 2021, a popular and reliable source of fundraising. As the economic landscape begins to settle after the crisis we expect companies with strong non-cash balance sheets to avail of opportunities to make strategic acquisitions and bolt-ons which will require access to cash in short order.

The team at Appleby are extremely well placed to advise clients in all legal aspects of a cash box structure having assisted a number of clients in the implementation of such structures both recently and historically. To further expedite matters we can coordinate with our colleagues in Appleby Global Services who are able to assist with every stage of the incorporation of the entities required to implement a cash box structure and any other related services which may be required.

Locations

Services

Corporate, Banking & Asset Finance, Corporate Finance, Derivatives, Fund Finance, Funds & Investment Services, Listing Services, Mergers & Acquisitions, Real Estate Finance, Structured Finance, Regulatory Advice

Sectors

Banking & Financial Services, Funds & Investment Services, Private Equity