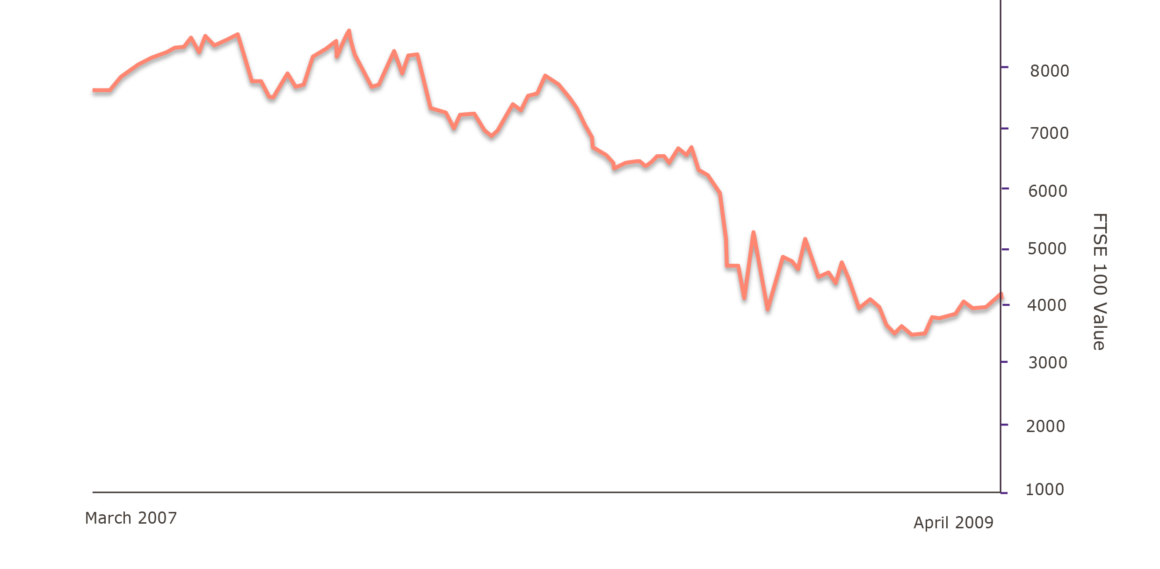

After the experiences of the credit crunch in the last decade, many professional trustees would no doubt agree. Unsurprisingly however, some beneficiaries may not! What duties do trustees actually have and what protection do they have?

SOME KEY PRINCIPLES:

“Investment” means, in simplistic terms, investing in assets which produce either income or capital growth. This means assets such as jets, yachts etc. bought for the beneficiaries’ personal use without expectation of growth/returns are not likely to be “investments”.

Trustees must act only within the specific powers they are granted in the trust instrument. For example, if the trust instrument prohibits investments in non-Islamic friendly/Shari’a compliant stocks, then an investment say in legal Italian brothels would be ultra vires and in breach of trust – regardless of whether it was a sound investment in terms of money returned.

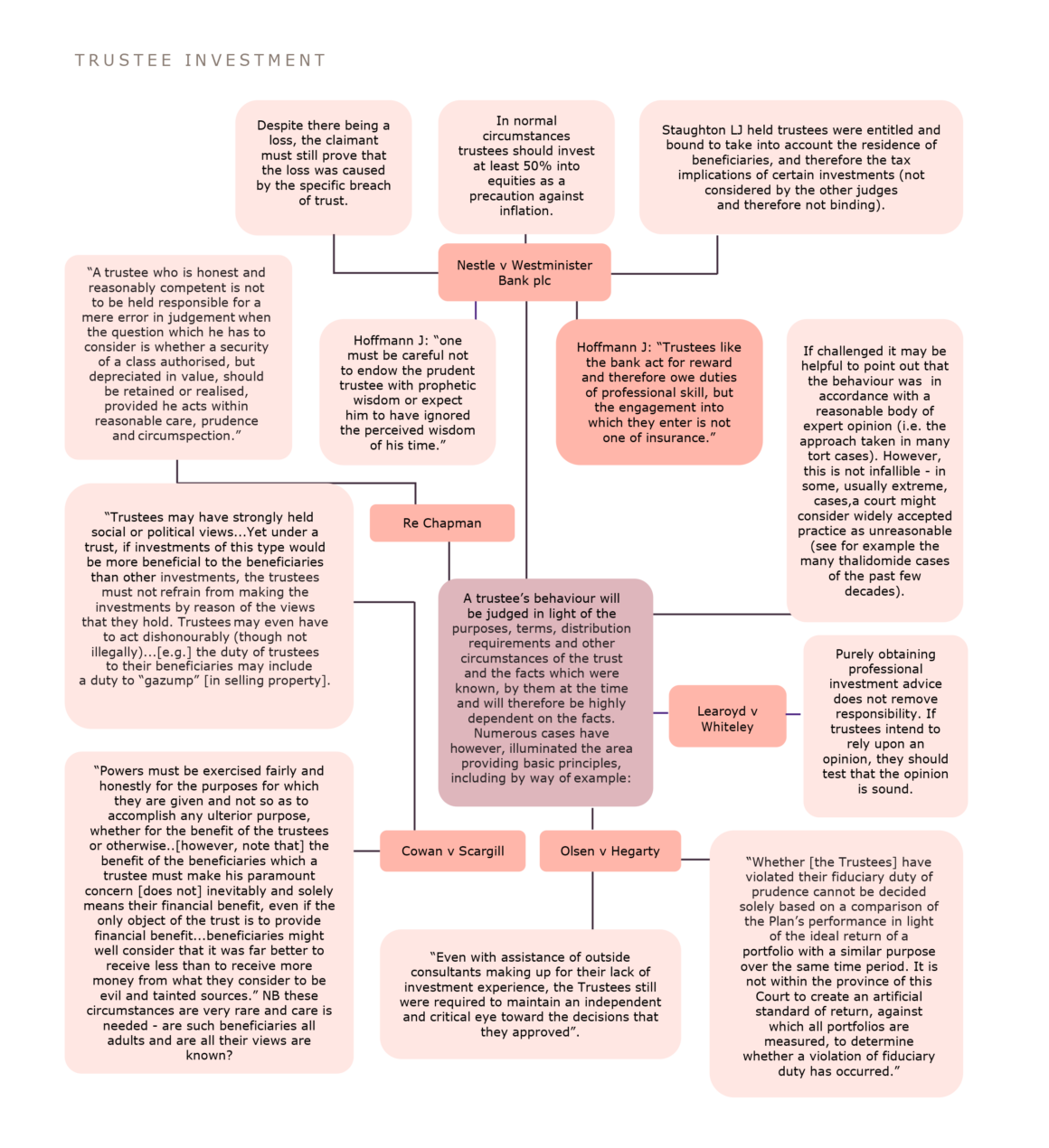

Trustees have the powers of a beneficial owner in relation to trust property (Art. 24(1) of The Trusts (Jersey) Law 1984 (Law)) but also a duty to act with prudence (Art. 21 of the Law) and only in the interest of the beneficiaries (Art. 24(2) of the Law). Therefore, as established under the 19th century English case of Learoyd v Whiteley in making investments a trustee’s duty is probably “not to take such care only as a prudent man would take if he had only himself to consider; the duty rather is to take such care as an ordinary prudent man would take if he were minded to make an investment for the benefit of other people for whom he felt morally bound to provide”. Some thoughts on what is “reasonable” are shown in the spider diagram below.

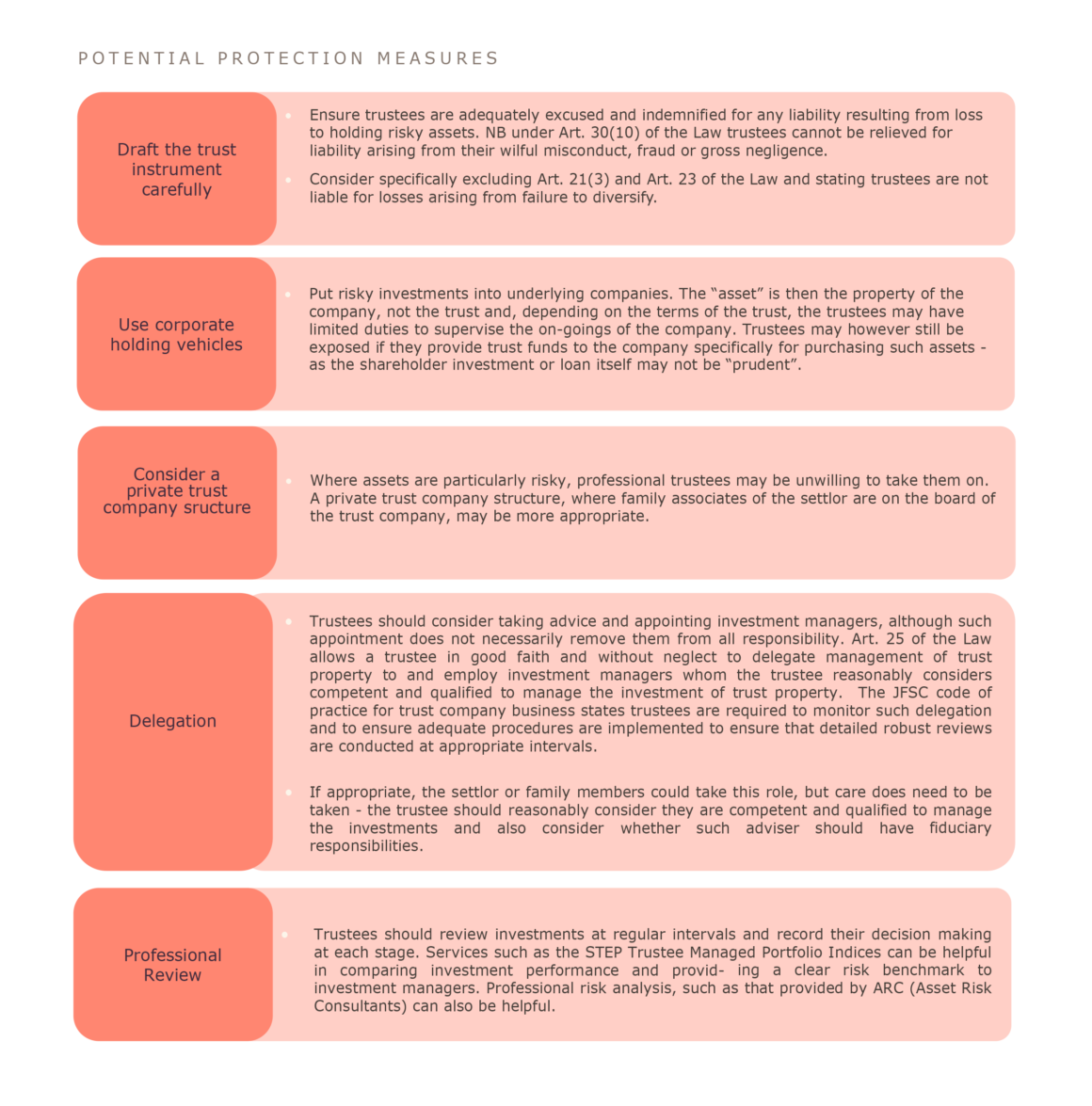

Trustees have a duty to “preserve and enhance, so far as is reasonable, the value of the trust property” (Art. 21(3) of the Law). However, these duties are often removed by the terms of the trust instrument to protect against market turmoil or indeed to comply with a restrictive or high risk investment policy envisioned by the settlor. However, the removal of such duties may not entirely protect the trustee and consideration should be given to overriding fiduciary duties (Art. 21(1) of the Law). A single high risk investment of a trust fund (even at the behest of the settlor) should cause the trustee to stop and think about the prudence of such an investment and look to seek express consent and indemnification from the beneficiaries as protection in case the investment fails.

Where there is more than one beneficiary/purpose, trustees must, subject to the terms of the trust, be “impartial and shall not execute the trust for the advantage of one at the expense of another” (Art. 23 of the Law). If there are successive interests, investments must therefore be balanced so both capital and income beneficiaries benefit – i.e. investments should produce both income and capital growth. In any event, prudent trustees should always consider diversifying assets.

For more specific advice on trusts in Jersey, we invite you to contact Giles Corbin or Nichola Aldridge.