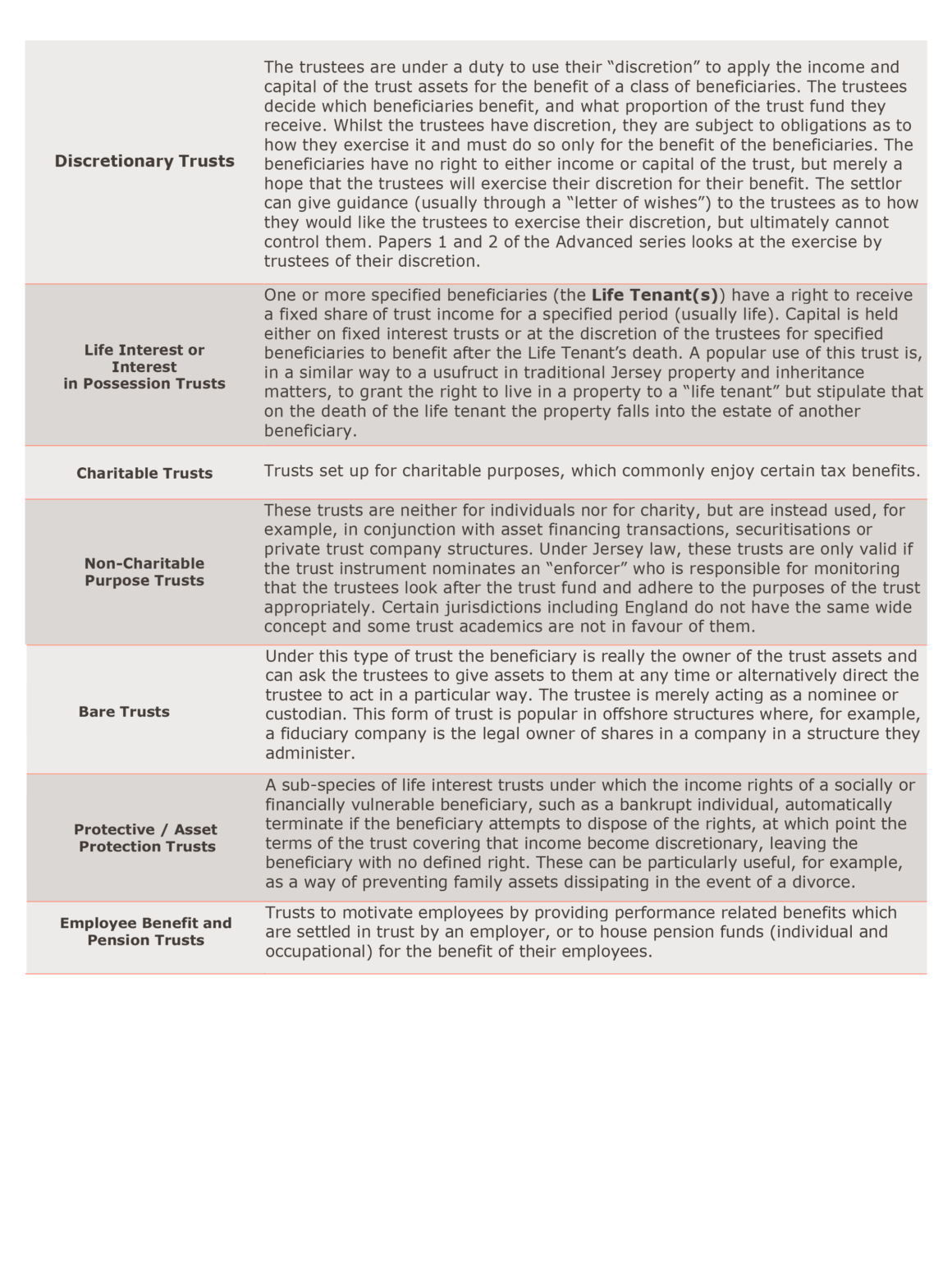

The “types”2 of trust commonly referred to by clients and used in Jersey include the following:

These “types” of trust can be extremely useful structures for dealing with a variety of issues including:

• Confidentiality: Assets are held in the name of the trustees, thereby keeping the identity and interests of the beneficiaries confidential. Jersey does not currently have a trust register.

• Succession Planning: Subject to certain forced heirship rules, trusts enable you to determine with greater flexibility exactly how your estate is distributed. For example, trusts are often established in wills to allow a second spouse to benefit from a property while alive but ensuring that the children of a previous marriage receive the estate when the spouse dies.

• Avoiding Probate: The deceased settlors assets are legally held by trustees and so do not form part of their estate on death. Probate, with its associated difficulties and costs, is therefore avoided.

• Asset Consolidation and Management and Asset Protection: A way of placing worldwide assets in one holding vehicle to simplify asset management and centralised financial reporting. In addition to establishing holding structures for wealth protection, growth and transition, a family office can be a tool to implement broader succession, leadership and governance plans. Trusts may also be used to protect assets from claims of future creditors to the extent permitted by law.

• Tax Planning: May be used to reduce tax liabilities in some circumstances. For example, since assets settled in trust do not form part of the settlor’s estate if settled within certain time constraints, inheritance taxes can be reduced.

• Protecting minors: Trustees looking after assets until children are mature enough to deal wisely with their finances protects children from having control over too much money too early, whilst the trustees can, if the appropriate trust is drafted, direct money for their education, maintenance and other needs

1 Private trusts as opposed, for example, to implied, resulting, public or constructive trusts.

2 Reserved power trusts are trusts that fall into any of the categories listed but where the settlor reserves certain powers or grants certain powers to third parties. These are looked at in paper 5 of the Advanced series.